Cit Bank Savings Account: A Complete Guide

Welcome to our complete guide on CIT Bank savings accounts! Whether you’re new to banking or looking to switch to a new financial institution, we’ve got you covered. CIT Bank offers a variety of savings account options to help you reach your financial goals. From high-yield savings accounts to certificates of deposit, CIT Bank has options to fit your needs. Read on to learn more about the benefits of opening a savings account with CIT Bank.

Overview of CIT Bank Savings Account

CIT Bank offers a variety of savings account options to help customers reach their financial goals. One popular option is the CIT Savings Builder account, which allows customers to earn a competitive interest rate. This account requires either a minimum balance of $25,000 or a monthly deposit of at least $100 to qualify for the highest interest rate. Additionally, CIT Bank also offers the Savings Connect account, which offers a competitive rate with the flexibility to make withdrawals. Both of these accounts can be easily managed through CIT Bank’s online banking platform, providing customers with convenient access to their funds.

One of the key benefits of CIT Bank savings accounts is the ability to earn competitive interest rates, which can help customers grow their savings over time. In addition, CIT Bank does not charge any monthly maintenance fees for their savings accounts, making it a cost-effective option for customers looking to save money. Customers also have the option to set up automatic transfers to their savings account, making it easy to consistently contribute to their savings goals.

Another advantage of CIT Bank savings accounts is the FDIC insurance coverage, which provides peace of mind knowing that deposits are protected up to the maximum amount allowed by law. This extra layer of security is important for customers looking to keep their savings safe and secure. Additionally, CIT Bank offers excellent customer service, with knowledgeable representatives available to assist with any questions or concerns that may arise.

Overall, CIT Bank savings accounts are a great option for customers looking to earn competitive interest rates, avoid monthly fees, and benefit from FDIC insurance coverage. With a variety of account options available, customers can choose the account that best suits their financial needs and goals. Whether saving for a specific purchase, building an emergency fund, or simply looking to grow their savings over time, CIT Bank offers a reliable and convenient banking solution.

Features and Benefits of CIT Bank Savings Account

CIT Bank offers a variety of benefits and features with their savings account that make it a great option for individuals looking to grow their savings. One of the key features of the CIT Bank Savings Account is its competitive interest rate. Compared to traditional brick and mortar banks, CIT Bank offers a higher interest rate on their savings account, allowing customers to earn more on their deposits.

In addition to the competitive interest rate, CIT Bank also offers a low minimum balance requirement for their savings account. This makes it accessible to a wide range of customers, including those who may not be able to meet the high minimum balance requirements of other banks. With CIT Bank, customers can start saving with as little as $100, making it a convenient option for those just starting on their savings journey.

Another benefit of the CIT Bank Savings Account is the option to set up a savings goal. Customers can create a specific savings goal, such as saving for a vacation or a down payment on a home, and track their progress towards that goal. This feature can help customers stay motivated and focused on their savings goals, ultimately helping them reach their financial objectives faster.

CIT Bank also offers 24/7 customer support for their savings account, providing assistance to customers whenever they need it. Whether you have a question about your account or need help setting up a transfer, the customer support team at CIT Bank is there to help. This level of support can give customers peace of mind knowing that they have a reliable resource to turn to for assistance.

One unique feature of the CIT Bank Savings Account is the ability to earn a cash bonus. By meeting certain requirements, such as opening a new account and maintaining a minimum balance, customers can qualify for a cash bonus. This incentive can be a great way to jumpstart your savings and earn some extra money along the way.

How to Open a CIT Bank Savings Account

If you are considering opening a CIT Bank Savings Account, you have made a wise decision. CIT Bank offers competitive interest rates and a range of benefits that can help you grow your savings over time. Plus, the process of opening an account is simple and straightforward. Here is a guide on how to open a CIT Bank Savings Account:

1. Visit the CIT Bank website: The first step to opening a CIT Bank Savings Account is to visit their official website. Once you are on the homepage, look for the option to open a savings account. Click on this and you will be directed to the account opening page.

2. Fill out the application form: The next step is to fill out the online application form. You will need to provide personal information such as your name, address, social security number, and contact details. Make sure to double-check all the information you provide to avoid any delays in the account opening process.

3. Fund your account: This is an essential step in opening a CIT Bank Savings Account. You will need to fund your account with an initial deposit. CIT Bank offers various options for funding your account, including electronic funds transfer, mobile deposit, wire transfer, or by mailing a check. Choose the option that works best for you and follow the instructions provided on the website.

4. Verify your identity: In order to comply with federal regulations, CIT Bank will need to verify your identity before opening your savings account. You may be asked to provide additional documentation such as a driver’s license or passport. This step is crucial for security purposes and to prevent fraud.

5. Review and confirm: Before finalizing the account opening process, make sure to review all the information you have provided. Check the terms and conditions of the account, including any fees or minimum balance requirements. Once you are satisfied, confirm your application and wait for approval from CIT Bank.

6. Start saving: Congratulations! You have successfully opened a CIT Bank Savings Account. Now it’s time to start saving and watching your money grow with the competitive interest rates offered by CIT Bank. Consider setting up automatic transfers to your savings account to make saving even easier.

Opening a CIT Bank Savings Account is a great way to start building your savings and reaching your financial goals. With their competitive rates and user-friendly online platform, managing your savings has never been easier. Follow these steps and start your savings journey with CIT Bank today!

CIT Bank Savings Account Interest Rates

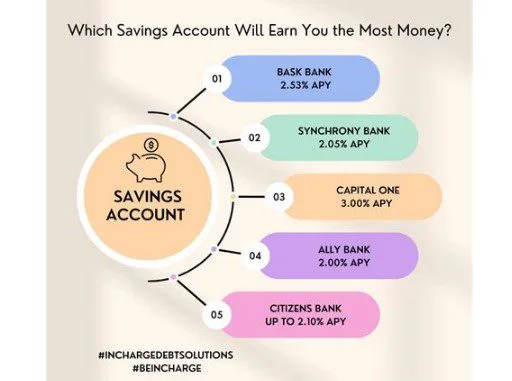

When it comes to choosing a savings account, one of the most important factors to consider is the interest rate. CIT Bank offers competitive interest rates on their savings accounts, making them a popular choice for savers looking to grow their money.

CIT Bank currently offers a high-yield savings account with an annual percentage yield (APY) of 0.45%. This is significantly higher than the national average for savings account interest rates, which is currently around 0.06%. By choosing a CIT Bank savings account, you can earn more money on your savings over time compared to a traditional bank account.

In addition to their high-yield savings account, CIT Bank also offers a variety of other savings products with competitive interest rates. Their money market account, for example, offers an APY of 0.50%. This account is perfect for savers who want quick access to their funds while still earning a competitive rate of interest.

For those looking to save for a specific goal, CIT Bank also offers a selection of CD (Certificate of Deposit) options with varying terms and interest rates. Their CD accounts range from 6 months to 5 years, with interest rates that typically increase with longer terms. Currently, CIT Bank’s 5-year CD offers an APY of 0.50%, making it a great option for savers looking to earn a higher rate of interest on their savings over a longer period of time.

Overall, CIT Bank offers competitive interest rates across their savings products, making them a top choice for savers who want to maximize their earnings. Whether you choose their high-yield savings account, money market account, or CD options, you can be confident that your money will be working hard for you with CIT Bank.

Tips for Maximizing Your Savings with CIT Bank

CIT Bank offers a variety of savings accounts with competitive interest rates to help you reach your savings goals faster. Here are some tips to help you make the most of your savings with CIT Bank:

1. Take Advantage of High-Interest Rates: CIT Bank’s savings accounts offer higher interest rates compared to traditional brick-and-mortar banks. Make sure to choose an account that offers the highest interest rate possible to maximize your savings potential.

2. Set Up Automatic Transfers: Automate your savings by setting up recurring transfers from your checking account to your CIT Bank savings account. This way, you can ensure that a portion of your income goes directly towards your savings goals without having to manually transfer the funds each time.

3. Monitor Your Account Regularly: Keep track of your savings account balance and interest earnings regularly. By monitoring your account, you can identify any discrepancies or unauthorized transactions and take action immediately to protect your savings.

4. Take Advantage of CIT Bank’s Rewards Program: CIT Bank offers a rewards program for their savings account customers, where you can earn cash bonuses for referring friends or meeting certain savings goals. Take advantage of these rewards to boost your savings even further.

5. Consider Opening Multiple Savings Accounts: To maximize your savings with CIT Bank, consider opening multiple savings accounts for different savings goals. By segregating your savings into different accounts, you can track your progress towards each goal more effectively and avoid dipping into funds earmarked for specific purposes.

6. Utilize CIT Bank’s Mobile App: Download CIT Bank’s mobile app to easily access and manage your savings accounts on the go. With the app, you can check your account balance, transfer funds, and set up alerts to stay on top of your savings goals.

7. Take Advantage of CIT Bank’s Relationship Rates: CIT Bank offers relationship rates for customers who maintain a certain minimum balance across their accounts. By consolidating your savings and meeting the minimum balance requirements, you can qualify for higher interest rates and boost your savings earnings.

By following these tips and utilizing CIT Bank’s savings account features effectively, you can maximize your savings potential and reach your financial goals faster. Start saving with CIT Bank today and watch your savings grow!

Originally posted 2025-01-12 21:55:46.